March 19, 2022 marked a monumental change in the U.S. appraisal industry when governmental-sponsored enterprises (GSE) Fannie Mae and Freddie Mac officially started accepting desktop appraisals — a historical transformation, as some would call it.

- Millions of appraisals are needed every year, and only 40,000 appraisers to complete them

- A looming problem waiting to explode

- Embracing technology to close the capacity gap

- A test pilot toward transformation

- A new way of working; the need for appraisers remains

- What appraisers are saying: Can the data be trusted?

- TL;DR

The announcement shook the appraisal world, leaving it flooded with thousands of questions and uncertainties. What does this new policy mean for the future of the industry?

Millions of appraisals are needed every year, and only 40,000 appraisers to complete them

In 2010, the Dodd-Frank act was passed in response to the 2008 housing crisis. This law was put in place to promote financial stability of the U.S. by improving accountability and transparency in the financial system. It also left a tremendous effect on the appraisal industry.

As a result, lenders and GSEs had to staff up to get appraisers on staff to tighten their quality assurance appraisals after the housing crisis. Many licensed appraisers left the practice and started working at larger banks instead.

According to Freddie Mac, there are only 40,000 active appraisers who are still carrying out the appraisal process — from property data collection to analysis and valuation. The total number of active appraisers hasn’t changed in the last 10 years. To add salt to the wound, the entry barrier into the appraisal industry is also becoming increasingly high.

When you put two and two together, it merely means there have been far fewer new appraisers entering the market for the past 10 years. Whereas, there are millions of appraisals that need to be done every year — and only 40,000 appraisers to complete them.

The math doesn’t add up.

A looming problem waiting to explode

Multiple problems have been brewing in the appraisal industry for years now, with the lack of capacity being the largest one. As of April 2022, even with the introduction of the appraisal waiver program in 2017, the market still saw:

- +50% in the number of appraisals needed but no change to the number of appraisers to meet this need.

- +24% in average cost of an appraisal to a consumer.

- +65% in average turntime (2-3 weeks) for an appraisal since 2018.

However, come July 2022, we’re also seeing an improvement in the above stats. What happened in just three months?

The answer: a real estate market slowdown in many areas of the country. But, this phenomenon is only temporary.

During a market slowdown, it typically means there are fewer appraisals to be completed. The number of appraisals is just one of the variables in this equation — the number of appraisers remains the same. It still doesn’t solve a larger long-term capacity problem the industry faces.

With the current average working age for active appraisers in the industry being closer to retirement age, the bigger question remains:

What happens when more appraisers retire from the industry in the next five years?

It is estimated that many appraisers will age out of wanting to do the most physically taxing part of the appraisal process in the coming years, which is to physically visit properties and measure them, and do everything that’s associated with that.

If no actions are taken now, and with few-to-no new appraisers entering the market, we have a major capacity problem looming and waiting to explode.

Embracing technology to close the capacity gap

To ramp up capacity in order for the industry to function like it used to, GSEs started testing the concept of hybrid appraisals in 2018.

This pilot concept involves sending another person—other than the appraiser—to the property for data collection. Once that is done, the appraiser can then complete the valuation based on the information they received.

In other words: Instead of having to do every single physical inspection by themselves, the process now brings the house to the appraiser’s desk with clear and accurate property data that were collected upfront.

A test pilot toward transformation

In 2019, the COVID-19 pandemic brought upon another set of challenges when social distancing restrictions came into effect. Appraisers weren’t able to go into homes to collect data as easily as before. But the show must go on. Thus, propelling the test pilot towards a total transformation in the appraisal industry.

The pandemic accelerated the adoption of the technology needed to allow appraisers to carry out their jobs. However, this change was not without questions nor uncertainties. And that is completely normal. Change—no matter big or small—is uncomfortable.

Perhaps, the biggest question remains:

What does this new policy mean for the future of the industry?

A new way of working; the need for appraisers remains

The objective of introducing hybrid and desktop appraisals is to streamline the entire home buying process in the real estate industry.

More importantly, to elevate appraisers into focusing on the hardest part of the process where they add the most value—analyzing the property and figuring out the market value of the property.

Appraisals typically cause a lot of uncertainties to both buyers and sellers in the real estate market due to their long turntime and lack of transparency. But, it is no fault of the appraisers themselves.

With more than millions of appraisals that need to be done and only 40,000 people to complete the job, none of these challenges should come as a shock.

Some may argue that the situation has begun to turn around and things are improving again. However, it is largely due to the current global market slowdown and is only temporary.

With so few new appraisers entering the market, it still doesn’t eradicate the long-term capacity challenge that is looming in the industry.

To tackle the decreased appraiser capacity, Fannie Mae introduced the new desktop option in March 2022. Mortgages that meet the following criteria will qualify for a desktop appraisal:

- Purchase transaction

- Single-family; one unit

- Primary residence

- LTV of 90% or less

Before we go further into the requirements for a desktop appraisal, let’s take a look at how the types of appraisals determine the way an appraiser works.

Traditional appraisals

A traditional appraisal requires the appraiser to do everything

Property data collection:

- Schedule appointments

- Drive to properties

- Take photos

- Collect data

Value conclusion:

- Neighborhood research

- Select comparables

- Make value adjustments

- Conclude + explain final value

Average appraisal turntime: 2-3 weeks

Desktop appraisals

A desktop appraisals eliminates the first part of the process for the appraiser — property data collection. Instead, they can rely on the data collected by multiple listing services (MLS) and floor plans to conduct the value conclusion.

Property data collection:

- MLS and floor plans

Value conclusion:

- Neighborhood research

- Select comparables

- Make value adjustments

- Conclude + explain final value

Average appraisal turntime: 2-3 days

Instead of going into the field for property data collection, desktop appraisals allow appraisers to redirect time and energy into doing what they do best—and the hardest to do—which is analysis, making adjustments, picking comparables, and valuations.

The new approach also yields a turntime of 2-3 days, making it possible to meet the demands of appraisals needed per year without burning out the existing capacity.

Floor plans bring accurate, consistent, and objective property information to the table from the get-go

Many appraisers stretch themselves thin with property visitations for each valuation. Bear in mind that the demand for appraisals go beyond purchase loans. They are also needed for refinancing or evaluating commercial spaces.

How long can we sustain this culture before we have a pool of burnt-out appraisers seeking to exit the industry?

With purchase loans making up a huge chunk of the mortgages issued, desktop appraisals lift the weight off appraisers in the most labor-intense part of the appraisal process—as long as the appraiser can access:

1. A recent MLS listing with required exterior and interior property photos

The minimum data requirements for property photos used for desktop appraisal include:

- Exterior photos: Clear, descriptive color photographs showing the front, back, and street scene that explains the neighborhood around the subject property.

- Interior photos: at the minimum, the report must include photographs of the following:

- The kitchen

- All bathrooms

- Main living area

- Examples of physical deterioration, if present

- Examples of recent updates such as restoration, remodeling, and renovation, if present.

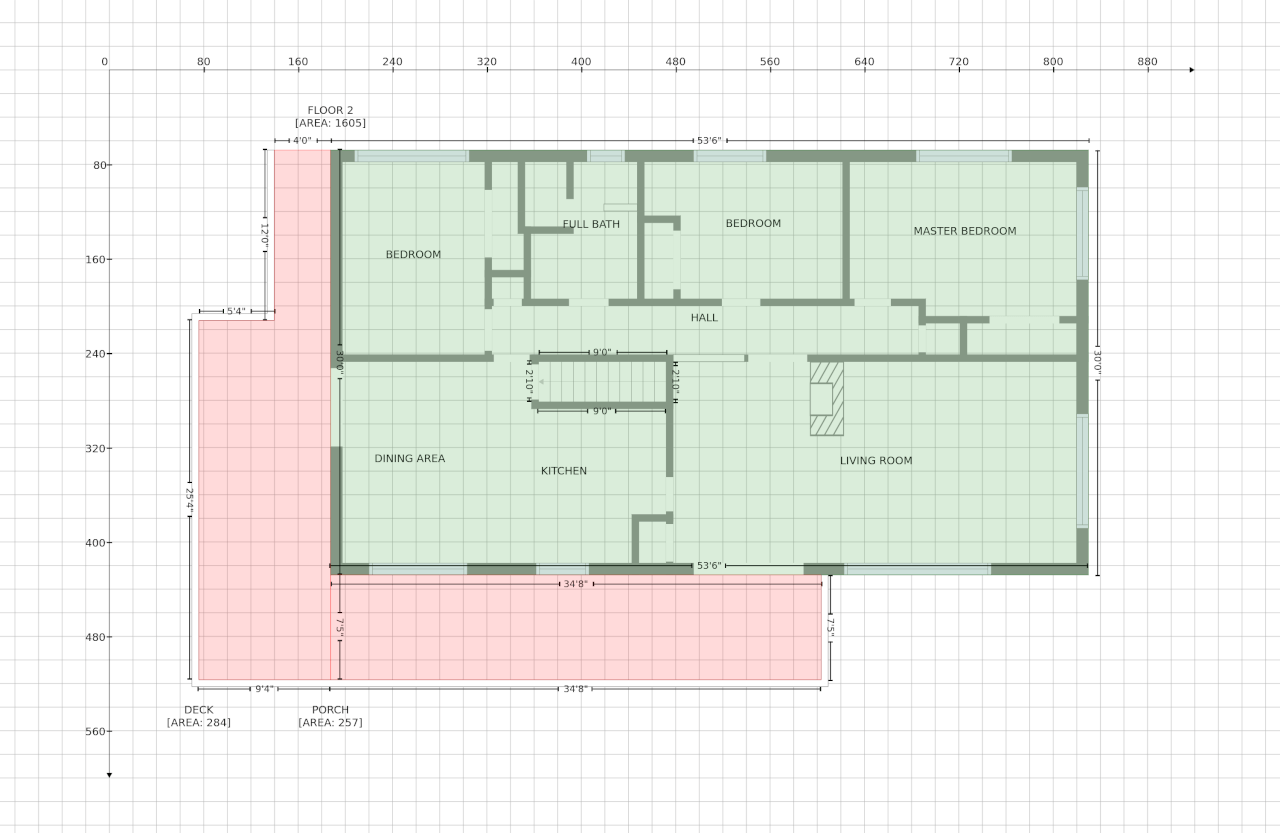

2. An ANSI compliant and accurate floor plan with interior walls, and detailed calculations showing how gross living area (GLA) was calculated.

Floor plans give appraisers a clear sense of the living area and the flow of a property without needing physical visitation. ANSI-compliant floor plans contain details and measurements needed to calculate the GLA square footage in the appraiser reports.

Essentially, floor plans are designed to give the appraiser everything they need to be successful in completing the appraisal process.

What appraisers are saying: Can the data be trusted?

Some of the primary concerns from appraisers include:

- Liability related to incomplete or inaccurate data from the third party

- Not wanting to liaise with buyers, sellers, and realtors for data collection

- Compromise of geographical competency due to the absence of fieldwork

- Inadequate fees

- Believing it’s bad for the profession

It is normal to be uncertain about changes—especially huge ones—and what they bring upon. Here are some of the answers to the concerns listed above.

Desktop appraisals will take a while to be fully integrated into the mortgage market

It is fair to say that while transformation is monumental, it is also a much-needed change for the industry. Appraisers play an economic role in the real estate market, and the decrease in capacity can severely impact the housing market in the near future.

The change in Fannie Mae’s and Freddie Mac’s policy doesn’t mean implementing an overhaul that happens overnight. In this case, it’s merely setting the groundwork to further stabilize the real estate market.

Appraisers have full control over the data reconciliation and reporting

The appraiser’s liability doesn’t change. The only thing that changes is that appraisers no longer need to go into the field for data collection.

That said, appraisers simply cannot make assumptions about the condition of the property if they feel they don’t have enough information to draw a conclusion.

There need to be sufficient information and data sources to verify the valuation. It’s entirely up to the appraiser to reconcile data and build a credible and defendable report they’re comfortable signing off on.

Floor plans are required for desktop appraisals

A floor plan is a non-compromisable element needed for appraisers to see the layout and calculate the GLA for desktop appraisals. As mentioned earlier, it is to help appraisers be successful in carrying out their jobs.

Appraisers are encouraged to use ANSI-compliant floor plans when carrying out desktop appraisals. In the case of a data discrepancy, it is still up to the appraiser to analyze different data sources and reconcile data before signing off on the report (refer to the previous point).

While it may take some time before desktop and hybrid appraisals become fully integrated into the mortgage market, it is the ripe time to try out a new way of carrying out real estate appraisals.

TL;DR

The traditional appraisal process is going nowhere and is here to stay. Desktop and hybrid appraisals are merely additional options, and ways of doing things, on top of the appraisal process that is available to us today.

A traditional appraisal process is best suited for complex and large properties that are hard to evaluate due to the lack of comparables for these types of properties. Whereas, desktop and hybrid appraisals are best suited for the vast majority of homes.

With millions of appraisals that need to be completed yearly and only 40,000 active appraisers to do the job now, this change is much needed. It is only the first of many to come in streamlining processes in the real estate industry.

To date, it still takes weeks for an appraisal process to be completed due to the most time-consuming and physically taxing part of the process — property data collection. As a result, the appraisal process remains the most nerve-wracking part of the home buying process for both sellers and buyers due to the wait time for a final decision.

In an ideal scenario, the appraisal process would look as such:

By having accurate, consistent, and objective property information upfront and ready for assessment at the beginning of the mortgage process, the appraisal process can be completed within days instead of weeks. More importantly, appraisers have more capacity to focus on doing what they do best and is most valuable to the home buying process—valuation.

On managing long-term appraisal capacity:

It takes years of training and hard work to become an appraiser; many of whom have gone through processes that are prone to massive amounts of human error, bias, and subjectivity.

Technology like CubiCasa digitizes and empowers the world’s population that has a smartphone to collect consistent, accurate, and objective property data to increase efficiency and reduce the risks of performing a bad appraisal.

On top of that, desktop and hybrid appraisals also free up massive industry capacity so that the appraisal industry remains to be manageable in the long run, even with the slower pace of new appraisers entering the market every year.

Desktop and hybrid appraisals are not introduced to replace the traditional appraisal process. Rather, they are there to complement it and to achieve the following:

- Ramp up capacity in order amidst declining workforce to prepare the industry for the future;

- Lower operating costs and friction for the appraisers;

- Reduce the risks of performing a bad appraisal and eliminate confirmation bias;

- Increase efficiency and minimize task switching during the appraisal process as you would in the traditional process; and

- Streamline the entire process in the real estate industry.

Simply put, there are massive possibilities for efficiency in the real estate process and for greater accuracy and transparency.

Also, check out:

-

How does an appraiser create a GLA floor plan for a complex property?

- [Podcast] Listing Bits Episode 72: Floor Plan Tech for Desktop Appraisals – with Jeff Allen of CubiCasaCommercial property

“Floor plans are better than whole virtual tours. Sometimes watching a video takes a longer time. [with a floor plan] I can visualize it much simpler.” – Greg Robertson

CubiCasa for appraisers

The output of each CubiCasa scan includes:

- Black and white marketing floor plan

- GLA floor plan with required GSE calculations

- Property data

Interested in CubiCasa?

CubiCasa offers standardized, fast, and accurate floor plans & GLA solutions for most iOS and Android devices. There’s no upfront investment or expensive hardware needed. You only need to download the app and scan a floor plan in 5 minutes.